July 9, 2022 — It is that time again to discuss the current economic trends, what that means for you and your family, and how you can prepare for what is coming. Longtime readers will be familiar with my style, I am usually 1-2 years ahead when it comes to making these kinds of forecasts so keep that in mind. I made some economic predictions back in December of 2020 that I assumed would be happening in 2021 but it appears I was one year ahead and that they are happening now. In that article not only did I make the claim that the Facebook, Apple, Amazon, Netflix, Google (FAANG) big tech stocks were way overvalued, I predicted they would eventually have to come down to reality. The example I used then was Apple — does anyone really believe Apple is worth $2 trillion? I warned about big tech accounting for 20 percent of the entire U.S. stock market and that being a potential bubble.

It appears that I may have been correct. The FAANG stocks are all down at the moment by quite a lot. I predicted trade wars, food shortages, I predicted the pandemic stimulus would be a corporate bailout, I predicted civil unrest and potential hyperinflation. It seems that all of those things have the potential to happen this year and 2023 if they haven’t already happened.

As I see it, we are rapidly approaching a recession. A recent survey by Fortune showed that 75 percent of Fortune 500 CEOs believe a recession is on the horizon. Jamie Dimon, the CEO of JP Morgan Chase, has been sounding the alarm about the economy. According to Bloomberg, last month:

Jamie Dimon warned investors to prepare for an economic ‘hurricane’ as the economy struggles against an unprecedented combination of challenges, including tightening monetary policy and Russia’s invasion of Ukraine.

‘That hurricane is right out there down the road coming our way,’ the JPMorgan Chase & Co. chief executive officer said at a conference sponsored by AllianceBernstein Holdings Wednesday. ‘We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself.’

Dimon said at JPMorgan’s investor day in May that there were ‘storm clouds’ looming over the US economy, but he said he’s since updated that forecast given the challenges faced by the Federal Reserve as it attempts to rein in inflation. – Bloomberg

Dimon has continued to make statements indicating he sees things getting worse. It’s not just Mr. Dimon who has been making comments like this. Many other analysts and investors are making similar claims.

Michael Burry who predicted the Subprime Mortgage Crisis and earned over $700 million for his investors has been tweeting about the economy and warning of a massive collapse. Last month Steve Burns wrote about the controversial Burry’s 2022 predictions. Like me, Burry is usually early in his predictions but he has had some major vindications:

Michael Burry is usually a year or two early in his trades and gets out a few months early but he is usually right in a huge way whether it was his early value stock picks, legendary short mortgage loans trade, Gamestop deep value investment in 2020 or Tesla short in 2021.

Here are a few of his past examples.

Michael Burry did his first subprime-mortgage deals on on May 19, 2005. He bought $60 million of credit-default swaps from Deutsche Bank—$10 million each on six different bonds. [1]

He sold them all by April of 2008 and made $100 million for himself and $700 million for his investors when his bet against the housing market paid off. [2]

In August 2019, Scion Capital announced that it had bought three million shares worth $16.56 million in gaming and electronics retailer GameStop. This means that Burry accumulated shares of Game Stop Stock at approximately $5.52 a share on average.

While he did not capture the parabolic run up in Gamestop (GME) stock to $438 a share in January of 2021 he did accumulate his position in the low single digit prices so he likely doubled, tripled, or quadrupled his money at least whenever he exited in the 4th quarter of 2020. We don’t know when he exited in the fourth quarter but we do know he missed the entire Wall Street Bets/Reddit 2021 run up. He was very close to pulling off the ultimate big long and they would have had to make a new movie if Christian Bale was available again. He was likely very happy to have made the triple digit return on his exit in 2020 as that is the goal of a deep value investor which is his primary methodology.

It appears he gave up on and exited his large positions in Tesla puts and ARKK puts and reduced his holdings dramatically on the last Q3 2021 13F filing as of 9-30-2021. He believed hyper inflation was inevitable but had trouble with his bearish stock bets going against him in the short term causing him to exit. He was very close to having another two huge big short positions pay off exponentially due to the position size and leverage of the put options but was just too early.

Now that we have established how accurate he usually is and how early he is let’s look at some of his recent predictions and what he is seeing on a macroeconomic level.

On February 19th, 2021, Burry began warning about inflation and excessive government stimulus. – Steve Burns

Here is Mr. Burry’s warning:

Burry is notorious for deleting and clearing his Twitter page frequently so screencaps are necessary.

Mr. Burns continues:

When he turned bearish in early 2021 he was in the minority, as most people in the financial world were bullish and central banks and politicians believed inflation was transitory.

At the time he warned about inflation it was still under the Federal Reserve’s target rate of 2%.

Michael Burry seems to be predicting a market crash in late 2022 in the below tweet. This was tweeted on June 13th, 2022 after the recent majority of the downtrend on stock charts meaning he sees more downside this year. – Steve Burns

Indeed, Burry has been warning of what he claims would be the biggest crash, as he thinks we are in multiple bubbles.

Here Burry is touting his own credentials a bit, and his ability to predict these things in advance. His credibility speaks for itself, despite what others have said about him being a “broken clock.”

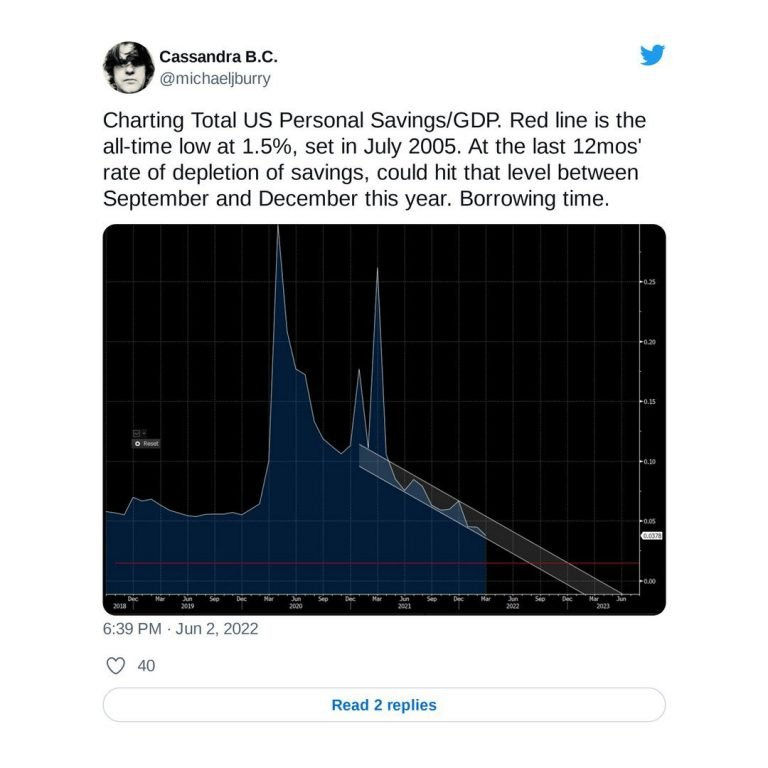

Last month Burry tweeted about total annihilation of consumer savings, which he sees as a sign of recession.

Here Burry makes note of what it is like seeing something happening, but being powerless to do anything to stop it. It is not enjoyable being right.

Like other analysts and investors, Burry is very good at noticing patterns. He understands human nature and that is something that has helped him making accurate predictions and forecasts.

Here Burry appears to be pushing back on people who would bring up a short term market gain. He is pointing out that those typically happen DURING recessions and that doesn’t stop the long-term negative trend.

Just last week Burry warned that the current market crash may only be about halfway over:

Investors may be only halfway through a debilitating market downturn that has already hammered stocks and leading cryptocurrencies, according to ‘Big Short’ investor Michael Burry.

Burry, the boss of Scion Capital Management, warned that company earnings are next to suffer from the effects of surging inflation and Federal Reserve interest rate hikes that have weighed on major stock indices and crypto tokens.

‘Adjusted for inflation, 2022 first half S&P 500 down 25-26%, and Nasdaq down 34-35%, Bitcoin down 64-65%,’ Burry tweeted on Thursday. ‘That was multiple compression. Next up, earnings compression. So, maybe halfway there.’

The broad-based S&P 500 closed out its worst first-half performance since 1970. The tech-heavy Nasdaq posted its worst quarter since 2008 and its worst first half on record.

Meanwhile, the price of bitcoin is down more than 70% from its all-time high of $69,000 last November — with several cryptocurrency firms scrambling to weather ‘crypto winter.’

Goldman Sachs analysts said current market levels have only priced in a minor recession — and warned that a sharper stocks selloff is still possible.

‘Much of the valuation de-rating this year has been due to higher rates/inflation,’ the Goldman analysts said in a note Thursday, according to Bloomberg. ‘Unless bond yields start to decline and buffer rising equity risk premiums due to recession fears, equity valuations could decline further.’

Like Burry, the bank’s strategists predicted that corporate earnings could suffer in the second half of the year as higher costs and slowing consumer spending weigh on bottom lines.

Burry issued his latest warning on the same day that the Fed’s preferred inflation gauge delivered another decades-high reading.

While inflation is showing some signs of leveling off, the latest Commerce Department data also showed a slowdown in consumer spending — a worrying sign as more banks warn of a higher recession risk.

Earlier this week, Burry argued that the Fed could end up reversing course on its plan for sharp interest rate hikes due to signs that some retailers are battling the ‘bullwhip effect’ — a supply chain phenomenon in which product demand forecasts don’t match actual sales, leading to wild swings in inventory levels.

Burry suggested that retailers will be forced to lower prices to get rid of their excess inventory, thereby cooling inflation and lessening pressure on the Fed to hike rates. – NY Post

Indeed, one of the things noted by Jaime Dimon last month was the introduction of quantitative tightening by the fed, which is the reverse of quantitative easing which has been Fed policy for the past several years. Dimon said the last time the Fed did QT, and it was only briefly — it threw the market into a tailspin.

Ray Dalio has issued some major economic warnings, and I highly recommend people read his new book “The Changing World Order.” He looks at historical cycles of empires and warns that America is in its terminal phase. Dalio has been taking advantage of the current economic storm, and his Bridgewater firm has profited during a time of downturn for most everyone else. Fortune explains:

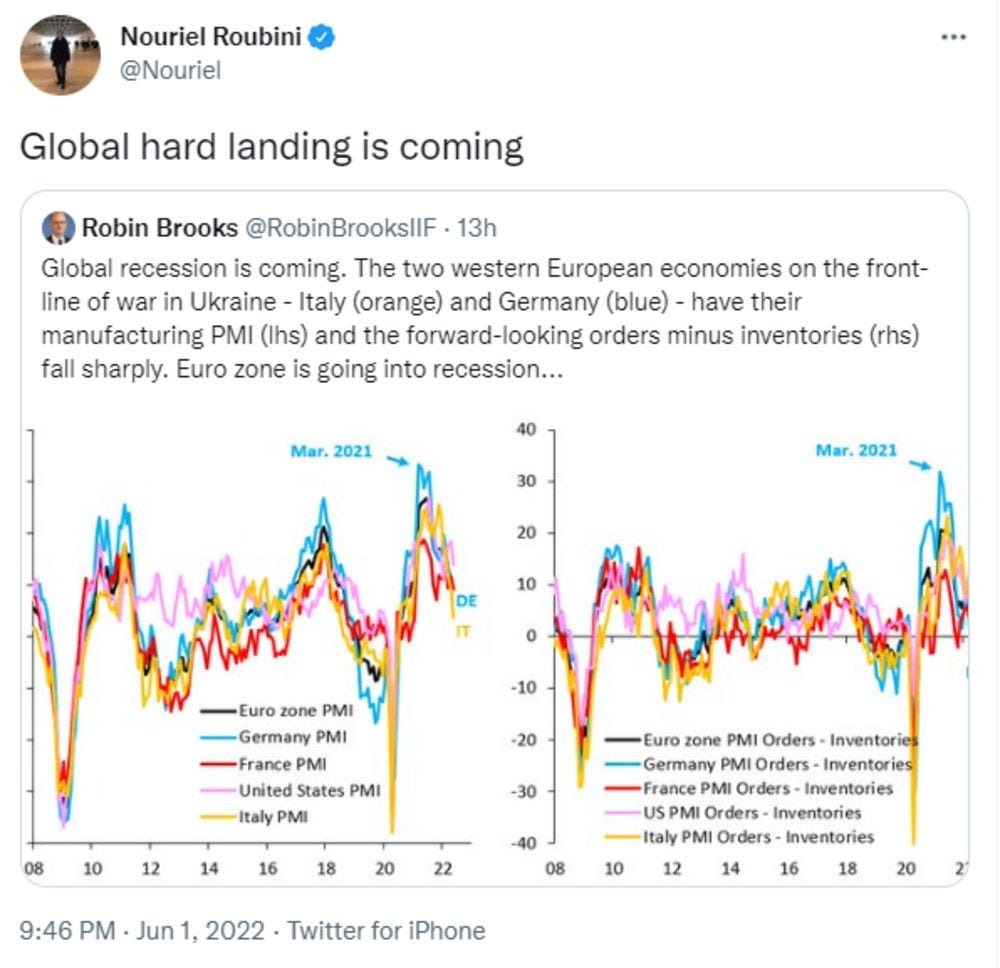

So how did Dalio and Bridgewater manage to outperform their competition so dramatically thus far in 2022? It all comes down to something hedge funds have became famous for in the wider culture: a big short.

Bridgewater’s impressive performance in the first half of the year was driven largely by a very public short bet against European companies.

In June, Dalio and company revealed they had ramped up their bets against European stocks to a sizeable $10.5 billion, Bloomberg reported. The firm now has short positions in 28 European companies, including the likes of Adidas and the German chemical and software firms BASF and SAP SE.

So far, the strategy has been exceedingly lucrative. All of the shorted companies are members of the Euro Stoxx 50 Index, which is down roughly 21% year-to-date, and some of the most heavily shorted names have seen their stocks plummet this year, leading to big profits for Dalio’s Pure Alpha II fund.

Remember, when an investor shorts a stock, they earn a profit when it falls.

Adidas’ stock is down 41% year-to-date, while BASF has sunk 42%, and SAP SE has fallen 36%, just to name a few.

Dalio first began shorting European equities following reports that economic growth in the Eurozone was slowing down due to rising inflation. On top of that, Europe’s reliance on Russian gas has led to an energy crisis on the continent as the war in Ukraine rages on, with the German government warning that its natural gas supplies may need to be rationed if Russia cuts off its supply entirely.

It’s a potential Lehman moment, Robert Habeck, Germany’s minister for economic affairs and climate action, told reporters in June, referring to the 2008 failure of the investment bank Lehman Brothers that made several hedge funds famous for their own big short against mortgage-backed securities.

‘Even if we don’t feel it yet, we are in the midst of a gas crisis. From now on, gas is a scarce asset,’ Habeck said, adding that if Russian supply is cut ‘the whole market is in danger of collapsing.’

Dalio has taken advantage of the turmoil in Europe, turning a considerable profit in a matter of months, and analysts aren’t shocked.

‘Given the deterioration in fundamentals and high inflation [in Europe] I am not surprised that they feel that this may be the beginning rather than the end of the correction,’ Patrick Ghali, co-founder of London hedge-fund advisory firm Sussex Partners, told MarketWatch this week.

Even before this year’s strong first-half performance, however, Dalio’s Pure Alpha II fund was one of the top-performing hedge funds on Wall Street. – Fortune

Dalio is clearly a keen observer and a smart investor. He has warned that we are on the brink of major war in the next 10 years. He believes that will be between the U.S. and China. He has warned about holding dead assets. Dalio, like Burry accurately foresaw the 2008 economic crisis. After the covid “pandemic,” Dalio warned the lockdowns would cause problems for years to come.

Yahoo Finance reports on Dalio’s warnings from just two days ago:

Some say cash is king. But according to Ray Dalio, founder of the world’s largest hedge fund Bridgewater Associates, it may not be wise to keep too much of your investment money in cash these days.

‘Cash is not a safe investment, is not a safe place because it will be taxed by inflation,’ Dalio told CNBC last year.

But 40-year high inflation isn’t the only thing that’s concerning the billionaire investor at the moment.

In a LinkedIn post last month, Dalio warns that Fed’s tightening could lead to stagflation – an economic condition marked by high inflation, but without the robust economic growth and employment that usually come with it.

‘My main point is that while tightening reduces inflation because it results in people spending less, it doesn’t make things better because it takes buying power away. It just shifts some of the squeezing of people via inflation to squeezing them via giving them less buying power,’ he writes.

‘Over the long run the Fed will most likely chart a middle course that will take the form of stagflation.’ – Yahoo Finance

David Wessel of the Brookings Institute disagrees, he recently stated that he doesn’t think we are in a recession.

Last Month, Morgan Stanley Wealth Management said that while we might be facing a recession, it may not be that bad:

The chances of a recession ticked higher last week, driven by the Federal Reserve’s latest rate hike and hawkish forward guidance.

The good news: If it does come to pass, a recession today is likely to be shallower and less damaging to corporate earnings than recent downturns. Here’s why.

Aside from the pandemic-induced 2020 recession, other recent recessions have been credit-driven, including the Great Financial Crisis of 2007-2008 and the dot-com bust of 2000-2001. In those cases, debt-related excesses built up in housing and internet infrastructure, and it took nearly a decade for the economy to absorb them.

By contrast, excess liquidity, not debt, is the most likely catalyst for a recession today. In this case, extreme levels of COVID-related fiscal and monetary stimulus pumped money into households and investment markets, contributing to inflation and driving speculation in financial assets.

The difference is important for investors. Historically, damage to corporate earnings tends to be more modest during inflation-driven recessions. For example, during the inflation-driven recessions of both 1982-1983, when the Fed raised its policy rate to 20%, and 1973-1974, when the rate reached 11%, S&P 500 profits fell 14% and 15%, respectively. This compares with profit declines of 57% during the Great Financial Crisis and 32% during the tech crash. – Morgan Stanley

What this Morgan Stanley report doesn’t focus on is the average American. The middle class are not institutional investors with lots of money and a diversified portfolio to weather the storm. In fact, the average American is living paycheck to paycheck. Bitcoin is down, stocks are down and money is down. So, what are some red flags that you need to be aware of that signal a recession is coming?

Layoffs

They have already started. In fact, some of the major FAANG companies that account for about 20 percent of the entire U.S. Stock Market have begun laying off employees. The ones that have not started laying off employees have initiated a hiring freeze. Two days ago, Business Insider reported on major student loan companies laying off employees are sparking a “panic,”:

A major student-loan company that let go of about 150 workers last month said it’s not planning to lay off any more of its employees.

But two people Insider spoke to, one a current and one a former Nelnet employee, are worried — especially as President Joe Biden is reportedly poised to forgive some portion of student debt over the coming months, a move that would greatly impact their industry.

Jo — a current Nelnet employee using a pseudonym for privacy — told Insider the lack of notice with the past layoffs has some employees in a ‘mass panic.’

‘We just didn’t know who was going to be next, and they weren’t saying anything to us,’ Jo said. ‘These people were being fired and removed without a word.’

Nelnet did not comment to Insider on the process it took for notifying workers of layoffs, but when Insider reported last month that Nelnet laid off about 150 employees, the company said it was due to lack of work caused by the over two year pause on student-loan payments, and although they were able to ‘redeploy’ some workers to different divisions. – Business Insider

I do not think the Biden administration is going to be forgiving any student loans. But the student loans industry, as well as “higher education,” have been a bubble for a while. Look at the value of college degrees these days, they are not worth the insane cost that schools and the student loan industry are now charging.

Two days ago, ReMax announced layoffs due to a “shift in strategy”:

The company said the layoffs are the result of its ‘shift in strategy’ to sunset its in-house technology platform in mid-2023 and instead partner with Inside Real Estate. – Biz Journal

Last month several companies, including crypto companies announced layoffs:

These layoffs come as macroeconomic factors are affecting companies. That includes the ongoing struggle between the Federal Reserve and inflation. As inflation continues to rise, The Fed has been increasing interest rates in an effort to stop it.

Unfortunately, the Fed has been unable to stop inflation from increasing. As that continues, more and more companies are looking to reduce their headcount as a way to protect profits during economic turmoil.

Companies that have announced layoffs:

Coinbase

Compass

Redfin

BlockFi

Tesla

DesktopMetal

WarnerBros Discovery – Investors Place

As you can see there are major layoffs coming during a time of rising costs of living.

On July 2 of this year, even more companies announced layoffs, such as:

WhiteHat Jr., Spotify, Olive AI, Netflix, Vauld, OneTrust, Fareye, CVS Health, TomTom, StartTek, Laceworks, BBC Four & CBBC, Uber, Bolt Financial, Meta (Facebook), AliExpress, Carvana, Ford, Robinhood, Noom, Conde Nast, J Sainsbury PLC, Baidu, Nestle, Unilever, Zillow, ByteDance, and more.

These mass layoffs and hiring freezes are a major indicator of a coming recession. On July 5th of this year, Crunchbase compiled a database of all the tech companies who have announced layoffs, which you can read about here.

Supply Chains

Supply chain problems have been an ongoing issue. Starting with the U.S./China trade wars in 2020 and exacerbated by the global pandemic. Now the Russia-Ukraine conflict has caused even more problems with global supply chains that still had not recovered from the pandemic. As if that wasn’t enough, China started new lockdowns, adding even more pressure to already fragile supply chains.

Financial Management Magazine reports on the supply chain woes:

Signs are growing that a global supply chain crisis which has confounded central bank inflation forecasts, stunted economic recoveries, and compressed corporate margins could finally start to unwind towards the end of this year.

But trade channels have become so clogged up it could be well into next year before the worst-hit industries see business remotely as usual — even assuming that a new turn in the pandemic doesn’t create fresh havoc.

‘We’re hoping in the back half of this year, we start to see a gradual recession of the shortages, of the bottlenecks, of just the overall dislocation that is in the supply chain right now,’ food group Kellogg CEO Steve Cahillane told Reuters.

But he added: ‘I wouldn’t think that until 2024 there’ll be any kind of return to a normal environment because it has been so dramatically dislocated.’

The global trade system had never contended with anything quite like the coronavirus.

Starting in 2020, companies reacted to the economic downturn by cancelling production plans for the next year, only to be blindsided by an upswing in demand prompted by rapid vaccine rollouts and fiscal support for rich-world household spending.

At the same time, virus containment measures and infection clusters triggered labor shortages and factory shutdowns just as consumer spending was shifting from services to goods.

European Central Bank Chief Economist Philip Lane likened the fall-out to the aftermath of World War Two, when demand exploded and firms had to quickly retool from production of military to civilian goods.

Export-led economies like Germany have seen recovery choked by supply bottlenecks to their factories, while surging shipping costs have combined with higher fuel prices to push US inflation to a four-decade high. – FM Magazine

Indeed, the supply chain disruptions we are witnessing now we have never seen before. The latest report from the Global Supply Chain Pressure Index indicates continues problems:

Supply chain disruptions continue to be a major challenge as the world economy recovers from the COVID-19 pandemic. Furthermore, recent developments related to geopolitics and the pandemic (particularly in China) could put further strains on global supply chains. In a January post, we first presented the Global Supply Chain Pressure Index (GSCPI), a parsimonious global measure designed to capture supply chain disruptions using a range of indicators. We revisited our index in March, and today we are launching the GSCPI as a standalone product, with new readings to be published each month. In this post, we review GSCPI readings through April 2022 and briefly discuss the drivers of recent moves in the index. – NY Fed

The NY Fed says that supply chains may continue to face problems due to recent geopolitical developments, China’s new lockdowns and increasing transportation costs.

American’s Relying More on Credit Cards

Consumers are relying more on credit card debt than ever before. USA Today reports on June 29, 2022:

As Americans grapple with the highest inflation in 40 years, the number of new credit cards have surged as more Americans rely on them to keep up with high prices. According to a recent report from the Federal Reserve, revolving credit (credit cards and lines of credit) increased by 19.6% from the previous year to $1.103 trillion.

This number is an all-time high, breaking the pre-COVID-19 record of $1.092 trillion in 2019. Credit card debt dropped to $974.6 billion in 2020 but that number has been increasing steadily as as inflation began to eat up more and more of Americans’ paychecks.

According to a survey by Equifax, Americans received 11.5 million new bank credit cards through February 2022. This is a 31.4% increase from the previous year. The total limits for these credit cards were $55.5 billion, a 59.2% increase from the previous year. Total credit limits now stand at $4.12 trillion, $224 billion above the pre-pandemic level.

Credit card balances fell by $15 billion per the Federal Reserve’s Quarterly Report on Household Debt and Credit. This is common as people pay down their credit cards from the holiday season. However, this is $71 billion higher than the balances from the first quarter of 2021, representing a large annual increase. – USA Today

Credit Card debt currently sits at around $841 billion.

Just two days ago a new survey found that Americans are now using credit more than debit cards:

With the economy hitting some sour notes, it looks as though the use of credit is on the rise. According to Credit Sesame’s latest Personal Finance and Credit survey, Americans are relying more on credit cards now than they were last year. In fact, the percentage of respondents who reported using more than half of their available credit limit increased by nine points when compared to last year’s survey. Additionally, 47% of those surveyed this year said they preferred credit cards to debit cards (40% chose debit). This was a near inverse of last year when 46% stated a preference for debit compared to 40% for credit.

Unfortunately, Credit Sesame’s survey also found late payments among consumers were on the rise. This year, 15% of respondents noted late credit card payments versus 10% in 2021. Meanwhile, more than one-third (34%) of those surveyed said that they spend more than 90% of their paychecks on expenses each month. This was double the 17% who said the same last year. Similarly, the percentage of those who said they spend more than 100% of their paycheck each month rose from 6% to 11%.

Also concerning is that a number of those surveyed displayed a lack of knowledge about their personal credit. For example, 1 in 6 surveyed did not know their credit score. What’s more, a surprising 40% didn’t realize that lenders utilize credit scores to evaluate creditworthiness. – Dyer News

Americans are already heavily indebted and economically illiterate and now they are taking on even more major credit card debt with lenders not even bothering to evaluate their ability to pay that debt back. As interest rates go up, along with cost of living, this can create an awful cycle. The Wells Fargo CEO has warned that rising costs of food and gas will deteriorate U.S. households and their ability to pay. Prices will keep rising because of inflation and interest rates will go up.

GDP Reports

It is generally believed that two quarters of declining GDP is an indication of a recession. Last month, the Washington Examiner reported:

The economy will shrink for a second consecutive quarter, a regional Federal Reserve bank projected Thursday in the latest sign of recessionary risks.

Gross domestic product growth will fall to a negative 1% annual rate, the Atlanta Fed’s ‘GDP Now’ tracker said in an update. The economy contracted at a 1.6% annual rate in the first quarter.

Thursday’s update was the first to show an economic contraction for the second quarter based on unexpectedly weak reports on consumer spending and business investment.

Personal consumption expenditures grew just 0.2% in May, the Bureau of Economic Analysis reported earlier Thursday morning. That growth was not sufficient to keep pace with inflation, meaning that real consumer spending fell in the month. – Washington Examiner

Indeed, it appears that we are already in the early stages of a recession.

Adrian Norman writes:

According to Fidelity Investment’s website, ‘two quarters of consecutive GDP contraction is the standard shorthand for a recession,’ which does technically mean the U.S. economy has entered the beginning of a recession.

The National Bureau of Economic Research (NBER) defines a recession as a ‘significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.’

While there is no guarantee the trend will continue, based on the latest Fed data, the U.S. has at least entered a recession phase. – Adrian Norman

Pay attention to the GDP next quarter.

Yield Curve

The yield curve has been a good indication of a recession. According to Yahoo Finance:

Most economists will tell you, there might be no sign of a pending recession more reliable than the inversion of the yield curve. Of course, it doesn’t help that they seem to be the only ones who really understand what an ‘inverted yield curve’ actually is, but so it goes.

The yield curve refers to a graph of the interest rates on Treasuries (government debt) of varying lengths. Money lent for longer periods of time normally has a higher rate to reflect the increased risk, so the graph usually slopes from lower rates for the short-term debt to higher rates for the long-term debt.

While the ins and outs of the market for government debt can be difficult to comprehend to the uninitiated, it plays a huge roll in the American economy. What’s more, the reliability of this particular indicator blows most of the others out of the water in the eyes of most economists.

But, every recession in the past century has seen the yield curve invert prior to the downturn in growth, so this has become one of the more closely watched signs. – Yahoo Finance

So, where is the yield curve right now? Well, on July 5, 2022, Reuters reported:

A closely watched part of the U.S. Treasury yield curve inverted again on Tuesday, as investors continue to price in the chance that the Federal Reserve’s aggressive move to bring down inflation will push the economy into recession.

Yields on two-year Treasuries briefly rose above those of 10-year Treasuries for the third time this year, a phenomenon known as a yield curve inversion that has in the past preceded U.S. recessions. – Reuters

This is another indication that recession is coming.

Declining Real Income

According to Investopedia, real income is defined as:

Real income is how much money an individual or entity makes after accounting for inflation and is sometimes called real wage when referring to an individual’s income. Individuals often closely track their nominal vs. real income to have the best understanding of their purchasing power. – Investopedia

Basically, real income is the real wage you are earning, after being adjusted for inflation. As inflation is rising, real income and purchasing power fall by the amount of inflation.

Real income continues to decline.

Inflation adjusted, real disposable income actually declined for the 10th time in 11 months in February of 2022 and this trend has continued. Basically, pay isn’t keeping up with inflation and we are seeing negative wage growth.

Rising Unemployment

Rising unemployment is another sign of a potential recession. According to Market Watch:

Some 235,000 people applied for jobless benefits last week, marking the highest number in six months and possibly signaling that layoffs are on the rise as the U.S. economy slows.

Economists polled by the Wall Street Journal forecast initial jobless claims to total 230,000 in the seven days ended July 2.

New filings had fallen to as low as 166,000 in late March — the second fewest on record — before moving higher over the past several months.

The four-week average of new jobless claims, which smooths out the temporary ups and downs, rose to 232,500. That’s the highest level since January.

The figures are seasonally adjusted. – Market Watch

Another thing to keep in mind is people who are already phased out of the market and are simply not being counted. Rising unemployment is one of a number of indicators that define a recession and exacerbate its downturn. The Bureau of Labor Statistics releases a monthly jobs report, which you can assess:

Here we have the unemployment rate.

Here are the jobs added. As of June, 2022 we have an unemployment rate of 3.6%.

Housing Prices & Sales Declining

Another indication of a potential recession is the decline in the housing market.

Single-family home sales are a reliable indicator of housing market strength.

New- and existing-home sales rates have declined in all four census regions.

Based on previous cycles, the recent downturn in U.S. home sales is consistent with a broader economic slowdown in the near term.

From the St. Louis Fed.

The Mortgage Bankers Association predicts prices to drop in late 2022.

Stock Market Crash

A downturn in the market is another indication of a potential recession. Business Insider reports on the current crash:

The hottest debate on Wall Street right now is whether or not the US economy will enter a recession in the months ahead.

Consumer spending — the driving force behind about two-thirds of the economy — is starting to slow down as the highest inflation rate in four decades hits budgets and the Federal Reserve hikes interest rates to cool demand.

Whether or not either factor hits the economy hard enough to drag GDP into the negative for two consecutive quarters remains to be seen. But as financial conditions tighten, the odds of a recession coming to fruition grow.

For Jon Wolfenbarger, the founder of Bullandearprofits.com and a former Allianz Global Investors securities analyst, the writing is already on the wall that a recession is coming. In a recent commentary, he laid out several reasons he sees the expansion ending.

The first is that real personal income has dipped negative year-over-year, which has historically only happened during recessions. Recessions are highlighted in the gray areas below.

Second, yields on the 10-year and 2-year Treasury notes inverted in April. Yields on 10-year Treasury notes are usually higher than those on shorter duration bonds. When yields on notes like the 2-year surpass the 10-year, it signals low confidence in the economy in the near-term. Yield curve inversions like this have preceded every recession since the 1950s.

Third, the spread between junk corporate bonds — or bonds issued by firms at the highest risk of defaulting on their debt — and Treasury bonds, which are viewed as risk-free, continues to rise, even as Treasury bond yields surge. This means investors are starting to sell riskier bonds at a higher pace as they become concerned with tightening financial conditions. – Business Insider

Stocks are currently down around 40 percent.

The S&P 500 performance, year to date shows a market decline of about 19 percent.

Most Americans Living Paycheck to Paycheck

Another sign of a coming recession is the number of Americans currently living paycheck to paycheck. At the end of June of this year, Consumer Affairs reports on the dire situation:

Consumers who spend all of their money between paydays are in good company. A survey by PYMNTS shows that 61% of U.S. consumers were living paycheck to paycheck in April, 9% more than in April 2021.

Even more affluent Americans have little to nothing left over when their next paycheck arrives. The data shows that slightly more than 1 in 3 people earning $250,000 or more annually currently live paycheck to paycheck.

The researchers found that these high-earning consumers handle their financial lifestyles in different ways. They are often associated with stronger credit scores and more intense credit usage and are likely to control their cash flows.

Consumers earning more than $250,000 a year are 40% more likely to use financial products than consumers in the lowest bracket, and as many as 63% of them have a credit score exceeding 750.

In other words, living paycheck to paycheck appears to be a lifestyle choice. If they have the money, they spend it.

On the other end of the scale, consumers with lower incomes who live paycheck to paycheck generally do so because of financial distress. They have fewer attractive credit options than wealthier consumers.

Those with lower incomes are also more vulnerable to the ravages of inflation. When the cost of food and energy rose sharply this year, lower-income consumers who live paycheck to paycheck had little option other than to cut spending or tap into expensive credit, such as credit cards.

A report from LendingClub shows things didn’t get much better last month, with more Americans turning to high-interest credit cards to make ends meet. Americans paid off billions in credit card debt during the first months of the pandemic in 2020 but since then have added to balances. The trend has picked up speed with inflation, which is at the highest rate in 40 years.

Unfortunately, the interest rate on credit cards has moved higher with the Federal Reserve’s policy of increasing interest rates. According to LendingTree, the average credit card interest rate is now over 20%.

When households live paycheck to paycheck, it means they aren’t saving any money. A recent Harris Poll shows inflation is eating up money that might normally go into a savings account.

The poll found that 39% of women said they are saving less money than they did last year. Another 40% of hourly workers with a household income of less than $100,000 said they are saving less than last year or not at all. – Consumer Affairs

This is pretty stunning, when you consider that even nominally “well to do” Americans who make over six figures are still living paycheck to paycheck and have nothing saved. This is two-thirds of Americans now living paycheck to paycheck.

While all of this looks like bad news, and certainly it is not good for those who are not prepared. I caution you to look at recessions not as a bad thing, but as a necessary thing. The market must be allowed to correct itself. Recessions also prove to be times of tremendous opportunity and many people have profited during economic downturns. Here are some things you can do to prepare yourself and your family for the tough times ahead:

Assess Your Financial Risk

Take a closer look at your personal finances and risks, if you see risks take actions to correct them. One of these risks could be your current location. Is this the place you want to be, if things get really bad? Is this a safe location for your family? Are you close to natural resources, etc. When you start looking at your financial risks, make sure you are doing so in terms of inflation adjusted rates, not today’s dollars.

Have A Savings Account

This is so important and it’s something that so many of us have forgotten. If you can, start saving, even if it is small amounts of money, like a few dollars. It all adds up over time. If you are invested, make sure you have a safe, well diversified portfolio. Could you survive financially if you lost your job? How long could you live off savings? What is the worst-case scenario and how can you work to make sure that doesn’t happen?

Do Not Keep Your Money in One Place

I am sure everyone is familiar with the phrase “don’t keep all your eggs in one basket,” and this applies in finances as well. Make sure your money is not all in one place. Have varied investments, maybe invest some in physical assets like gold, or even digital assets like crypto but make sure you do your research before making these investments.

Get Rid of Your Credit Card Debt

I cannot stress this enough. If you have credit card debt start working now to pay off that debt. With a recession on the way, interest rates are going to be rising rapidly. You do not want to have to deal with that during a time of great uncertainty. Matt Schultz from Lending Tree has recommended if you have debt you want to quickly pay off that you could take out a low interest personal loan to pay off that debt. He also recommended calling all your credit issuers and asking for a rate reduction.

Establish a Emergency Fund

This is very similar to having a savings account, but in case of a job loss you will need that savings for your monthly bills. An emergency fund is something you will need in the event of a medical emergency that requires surgery or medications that will go beyond your monthly bills.

Get a Side Hustle

Every single one of you reading this has skills. You have something you are good at, that no one else is. You have some talent or some interest that you can develop and turn into something more than a hobby. Whether it is making YouTube videos, or making homemade teas, there is something that you can do that you can potentially monetize.

Join a Group

You should look into joining a local group in your community geared towards things like prepping and self-defense. There is always safety in numbers and the more people you know in your area, the more potential resources you have in the event of an emergency. If you know someone who is a nurse or a doctor in your community and you have an unexpected medical emergency, you could reach out to them and ask for their help. You might be able to negotiate a way to pay them that doesn’t require cash up front, like perhaps in exchange for their help you agree to do work on their house or something like that. Bartering will always come in handy. Ultimately, your goal is to create a strong local group that can come together and pool resources during times of hardship.

Conclusion

According to all metrics, it looks like we are headed for a recession and things may get much worse before they get better. It’s impossible to know how bad it will get and how long it will last. If the subprime mortgage crisis is any indication, we could be looking at a major collapse with people facing joblessness and eviction and homelessness. You don’t want to be in a bad position when things go south; make sure you start preparing yourself and your family now. That way when things do get bad you will be in a position to take advantage of the downturn. There are always people who make money during these times. Make sure you start living more frugally in anticipation of this. You can begin by cancelling subscription services that are not necessary. Do you really need Netflix? Then start trimming fat elsewhere — do you really need that fancy coffee on the way to work? Do you really need to go out to eat, or can you start cooking more? Try to learn things like canning and start your own small garden. If you can, look into buying chickens or some kind of animal that produces food. Develop savings and a side gig. Most importantly, pray and pay attention to what is going on.

Wow.

I suggest get out of the city's and prep get gold and silver store food and try to get with others of like mind so you can help each other with what's coming I'm a Iraq vet and this is going to be worse than what I dealt with in the war